Fieldworker Earnings Dashboard & Pay Statements

Fieldworkers need absolute clarity on what they’ve earned, what’s still owed, and when money will hit their bank accounts. OctopusPro’s My Earnings dashboard delivers that visibility in real time, while giving administrators the audit trail they need for payroll and compliance.

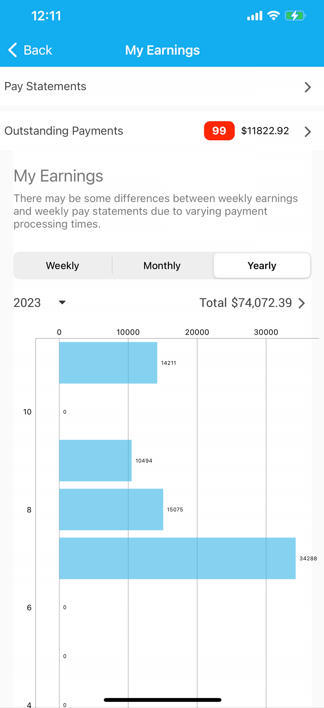

What Is the My Earnings Dashboard?

OctopusPro bundles three must-have pay tools—Real-Time Earnings, Outstanding Payments, and Pay Statements—into one mobile tab. Earnings dashboards on apps have been shown to boost fieldworker performance and retention because income transparency reduces anxiety over when (or whether) they will be paid.

Industry research echoes this: 79 % of gig workers say legal pay-transparency rules would build trust, and 55 % of employees rely on each paycheque to cover essentials, making clear, timely payroll data critical.

Accessing the Dashboard

- Open the Menu → My Earnings (fieldworker role).

- The top ribbon shows Week | Month | Year filters. Tap to switch views.

- Pull down to refresh; figures update as soon as a job status changes to Completed.

Tip: Encourage crews to pin the My Earnings tab to the bottom nav (Settings → Shortcuts) so earnings are never more than one tap away.

Viewing Real-Time Earnings

| Filter | Typical Use Case | Example |

|---|---|---|

| Weekly | Payday recon | A cleaner checks Mon–Sun totals before approving her timesheet. |

| Monthly | Tax set-asides | An HVAC tech earmarks 30 % of April earnings for quarterly GST/ATO payments. |

| Yearly | Performance reviews | Admin exports a yearly CSV to compare fieldworker billables v. labour costs. |

Tap any total to open a component drill-down—base pay, extras, bonuses, deductions.

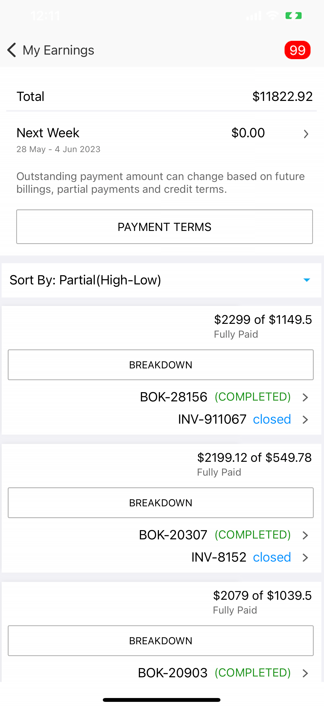

Managing Outstanding Payments

Select Outstanding Payments to list every job that has been invoiced to the customer but not yet paid to the fieldworker. Fields include Job ID, Client, Amount, Scheduled Pay Run, and Due Date. This helps fieldworkers chase late invoices without calling the back office.

When a customer pays online, the entry auto-clears and the amount flows into the next scheduled pay run.

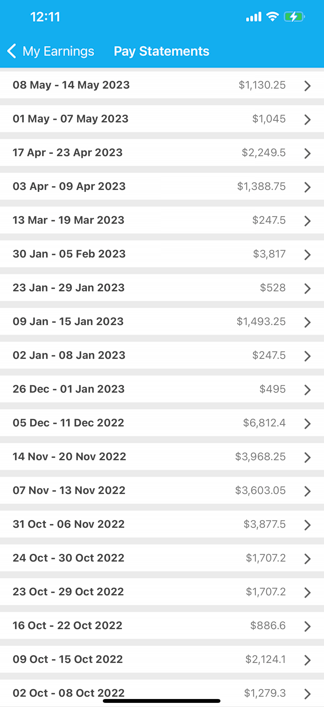

Accessing Pay Statements

Digital pay statements satisfy most Fair Work Australia and U.S. record-keeping rules—even though FLSA doesn’t mandate handing them out, many states and clients do.

- My Earnings → Pay Statements.

- List is reverse-chronological; PDFs open in-app and can be emailed or AirDropped.

- Each statement shows Gross, Commission, Deductions, Net, plus tax IDs.

Benefits at a Glance

| Stakeholder | Benefit |

| Fieldworker | Instant pay visibility reduces financial stress and improves job satisfaction. |

| Dispatcher | Fewer “When will I get paid?” calls free up staff time. |

| Finance | GPS-verified hours and automated commission exports cut payroll errors. |

| Compliance | Digital statements and location-stamped timesheets meet audit trails. |

Admin Controls & Security

Admins can:

- Define pay cycles (weekly, fortnightly, monthly).

- Map pay components (overtime, allowances) to accounting codes.

- Lock statements after review to prevent disputes.

All actions are logged under Payroll Audit Trail for SOX-style compliance.

Frequently Asked Questions

Will disabling a service affect past earnings?

No. Earnings are tied to job completion, not current service settings.

Why don’t I see a recent job in Outstanding Payments?

It may still be in Pending Approval status; once the admin signs off, it appears automatically.

By merging live job revenue, outstanding payments, and formal pay statements into a single mobile tab, OctopusPro arms your workforce with the transparency they demand and the compliance controls your finance team requires. Encourage fieldworker to review My Earnings regularly to stay motivated, spot discrepancies early, and ultimately drive higher performance.

To stay updated, please subscribe to our YouTube channel.