Converting an Invoice to Void

The ability to void an invoice can be useful when an invoice is issued in error or is no longer required. However, this operation comes with limitations, such as the inability to void invoices with approved payments. This guide provides detailed instructions on how to void an invoice in OctopusPro and discusses its use cases, benefits, restrictions, and impact on your synced accounting systems such as Xero and QuickBooks.

Use Cases

- Invoice Error: If an invoice was created with incorrect details, voiding the invoice allows you to correct the error without disrupting your accounting records.

- Canceled Service: If a service is canceled post-invoice issuance, voiding the invoice maintains account accuracy.

- Duplicate Invoice: Void one copy of the invoice in case of accidental duplication.

Benefits

Voiding an invoice in OctopusPro helps maintain accurate and up-to-date financial records. It provides an organized account of all transactions, valid or voided, providing a clear audit trail.

Understanding the Concept of Voiding Invoices

Voiding an invoice essentially cancels the invoice as if it was never issued. It maintains a record of the invoice within your accounting system but changes its status to ‘void’, indicating that it no longer affects your accounts receivable and no payment is expected. Voiding is commonly used in situations where an invoice was created in error or needs to be canceled for some reason, such as the cancellation of a service or a mistake in the invoice details.

On the other hand, deleting an invoice completely removes the record from your accounting system. It’s as if the invoice never existed. This action is generally discouraged because it disrupts the continuity of your invoice numbering and it might complicate your audit trail, making it harder to track past transactions.

As a general rule:

- Void an invoice when: You want to cancel the invoice but keep a record of it. Voiding is a good choice when you have already sent the invoice to the customer, especially if the invoice has been reported in your tax filings.

- Delete an invoice when: The invoice was created completely in error (like a duplicate invoice) and has not been sent to a customer or reported in any way. Be cautious with this action, as deleting an invoice removes all historical records of it.

- Do not void an invoice when: The invoice has received approved payments. In OctopusPro, invoices with approved payments can’t be voided to prevent discrepancies in your financial records.

- Do not delete an invoice when: The invoice has been sent to a customer or included in your tax filings. Deletion should only be considered if the invoice has not been used in any way.

In conclusion, whether you choose to void or delete an invoice depends on your specific situation and needs. Both actions have their uses but also potential complications, so use them judiciously.

How to Convert an Invoice to Void

Voiding an invoice in OctopusPro is straightforward. However, please note that invoices with approved payments added to them cannot be voided.

Follow these steps to void an invoice:

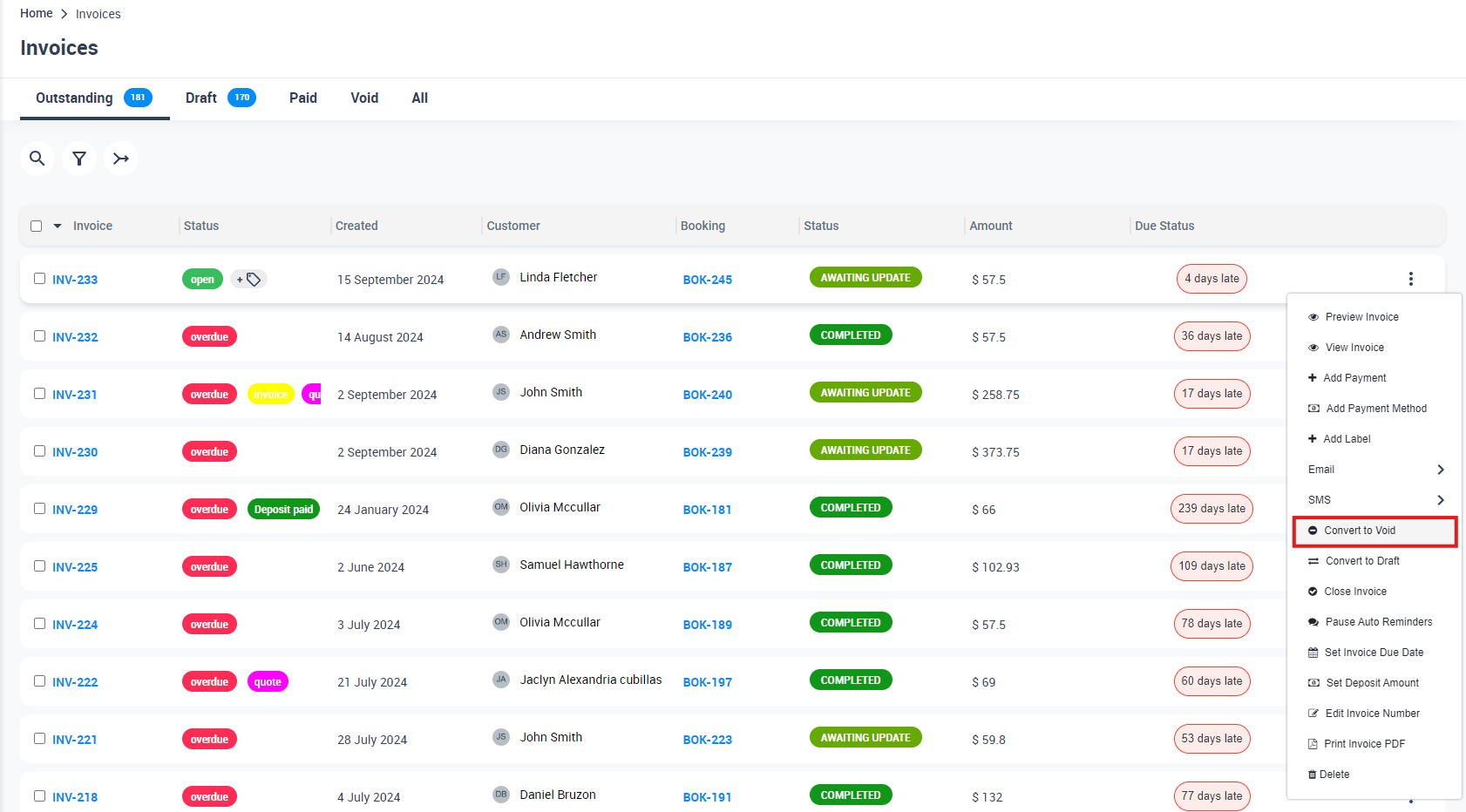

Convert an Invoice to Void from the Invoice List page:

- Log into your OctopusPro account.

- Navigate to the “Invoices” section.

- Select the type of invoice you wish to view or select “All Invoices”.

- Locate the invoice you want to void.

- Click on the “Actions” button next to the relevant invoice.

- Select “Convert to Void” from the dropdown list.

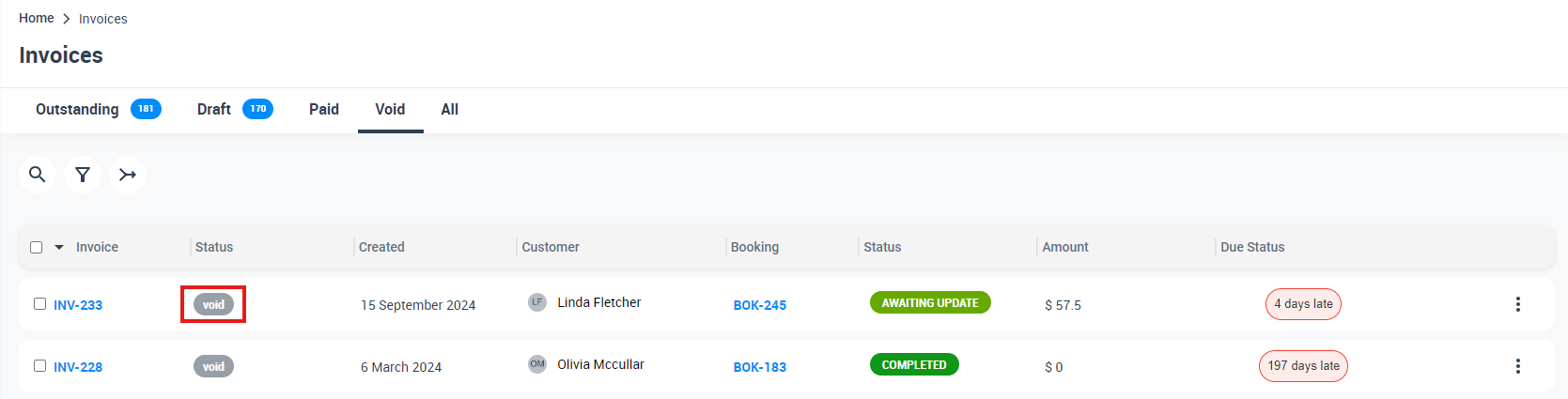

Once clicked, the invoice status will be converted to Void and it will appear in all invoices void list.

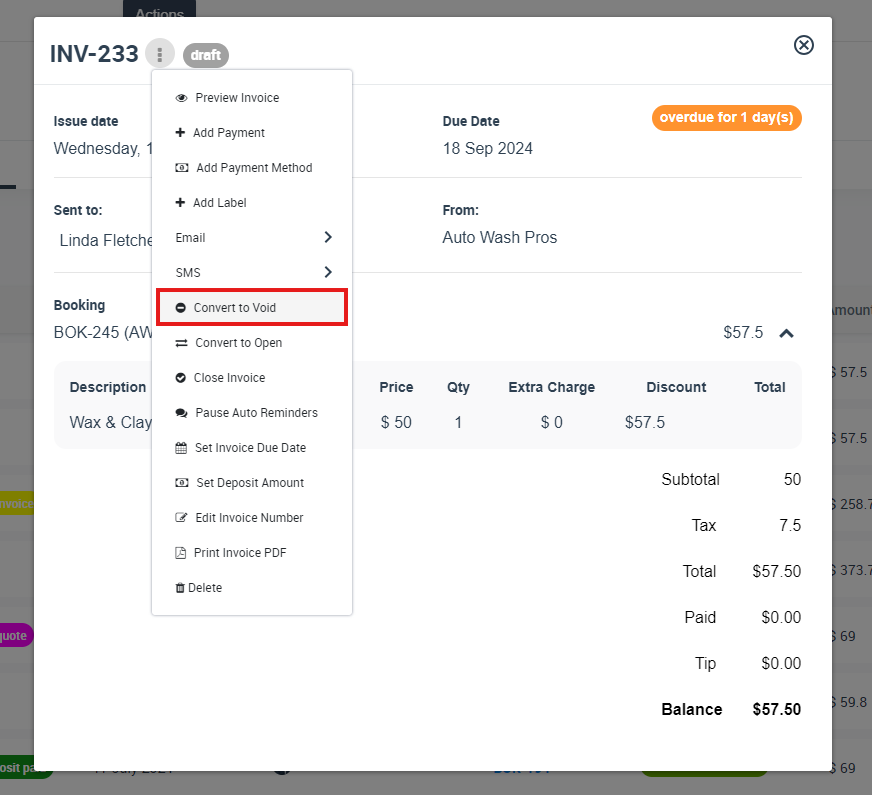

Convert an Invoice to Void from the Invoice Details page:

- Go to the specific invoice you want to void.

- Click on the “Actions” button next to the invoice number.

- Select “Convert to Void” from the dropdown menu.

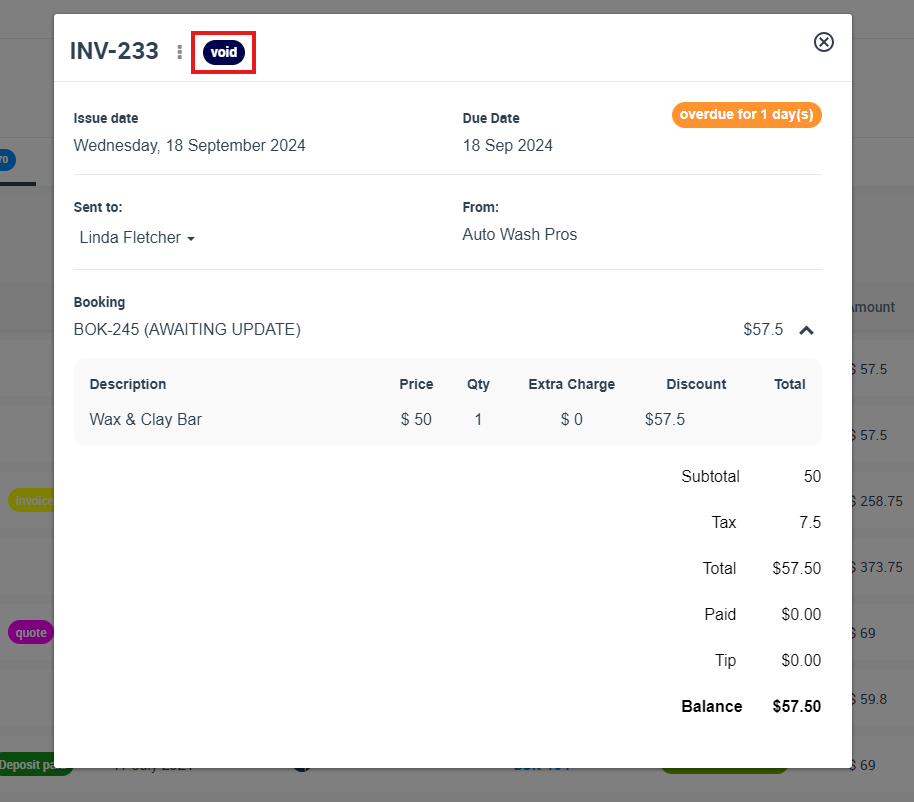

After following these steps, your invoice status will be changed to void, unless there are approved payments attached to it.

Limitations and Restrictions

While voiding an invoice is a valuable function, there are some limitations:

- Approved Payments: Invoices with approved payments added to them cannot be voided. This restriction is to prevent any discrepancies in your financial records.

- Financial Reporting: Invoices that have been included in financial reporting or tax filing should not be voided without proper revision and consultation with your accounting team or advisor.

Impact on Synced Items with Xero and QuickBooks

When you void an invoice in OctopusPro, this change is not immediately reflected in synced accounting systems like Xero or QuickBooks. These changes are updated in the next sync process.

It’s crucial to initiate a new sync after voiding an invoice to ensure consistent and accurate financial records across all platforms.

As a standard practice in the accounting industry, voided invoices are typically marked as “void” and retained in the system for a complete financial record.

Voiding an invoice in OctopusPro helps manage incorrect or invalid invoices while maintaining accurate financial records. Remember to regularly sync your OctopusPro with your accounting software for consistency across platforms and consult with your accounting team before voiding invoices included in reports or filings.

To stay updated, please subscribe to our YouTube channel.