Unknown Payments & Reconciliation Actions

Need to tame “mystery money,” fix a payment that’s tied to the wrong invoice, or undo a hasty approval?

This consolidated guide covers every cash-management workflow in OctopusPro: importing unknown payments from a CSV file, matching or bulk-matching them to invoices, approving or rejecting them with dual control, and safely unassigning (rather than deleting) a payment that was linked to the wrong job. Together, these tools keep A/R accurate, protect audit trails, and prevent you from double-charging customers or under-paying fieldworkers.

What counts as an “unknown” payment?

Most “unknown” rows arrive when you import a CSV that wasn’t created by a live-connected gateway:

| CSV source | Why it lands in Unknown Payments |

|---|---|

| Bank-transfer file exported from your online banking portal | No invoice or customer ID in the flat file |

| Legacy card deposits processed before you linked Stripe/Square to OctopusPro | Back-loading historical revenue |

| External POS or non-integrated gateway (e.g., PayPal Here, local EFTPOS) | You upload the batch so OctopusPro becomes the single source of truth |

| Bulk EFT covering many invoices | One deposit, multiple jobs, no one-to-one references |

All imported lines stay in Finance › Invoices › Unknown Payments until you match them to a customer and invoice.

Why clear the queue quickly?

- Accurate A/R & P/L — unmatched cash inflates revenue or receivables

- Faster fieldworker pay-runs — cleared invoices feed payroll rules

- No duplicate requests — prevents “You still owe us” emails

- Audit compliance — time-stamped matches satisfy audit standards

Assigning unknown payments

1. Locate & filter

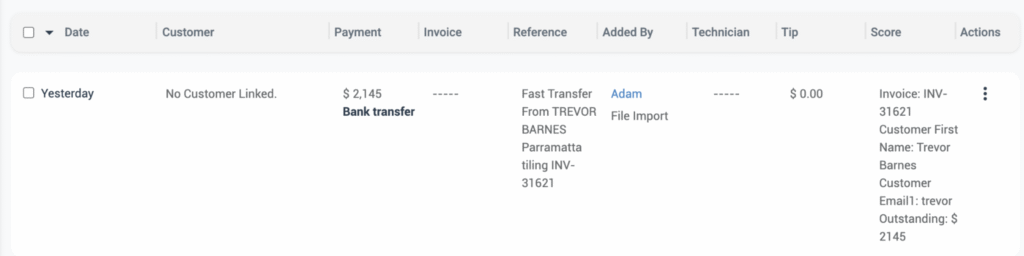

Open Finance → Invoices → Payment Reconciliation → Unapproved. Filter by amount, date, reference, or “No Customer Linked.”

2. Match a single line

- … Actions → Add to Invoice

- Choose the invoice → Save. Status flips to Unapproved (or Approved if you have permission).

3. Auto-match engine

OctopusPro pre-suggests links using amount, customer, reference, and date proximity, similar to Stripe & Xero auto-reconciliation.

3 Auto-match engine

OctopusPro uses an AI-assisted matching algorithm—modelled on the automatic-reconciliation rules in QuickBooks Online and Xero—to suggest the most likely invoice for every imported payment. It scores potential links by comparing amount, outstanding balance, customer name, keyword patterns in the reference line (e.g., “INV-31621”), bank account, and transaction date-proximity.

- Unapproved by default – even when the algorithm finds a 100 % match, the row stays in the Unapproved tab until an authorised admin clicks Approve.

- Multiple possible matches? The grid shows a blue badge such as “2 matches”. Click the badge to review each candidate invoice, pick the right one, then hit Approve.

- Wrong suggestion? Open the … Actions menu and choose Reassign Invoice to link the payment to a different invoice, or Unlink Invoice to send it back to Unknown/Unlinked for later handling.

This keep-it-pending approach protects your ledgers from false positives while still cutting manual matching time by up to 90 %.

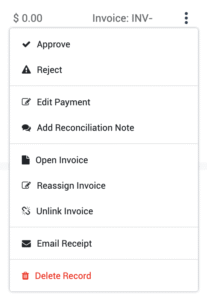

Row actions menu explained

| Action | Use when | Result |

|---|---|---|

| Approve | Match confirmed | Moves to Approved; invoice balance updates |

| Reject | Duplicate / wrong currency | Sends to Ignored; audit trail kept |

| Edit Payment | Wrong amount or method | Inline edit; rev-history logged |

| Add Reconciliation Note | Explain split payments | Time-stamped memo |

| Open Invoice | Check line items | Opens in new tab |

| Assign Invoice | Assign payment to an invoice | Links payment |

| Reassign Invoice | Deposit belongs elsewhere | Relinks payment |

| Unlink Invoice | Will cover several invoices or become credit | Sends back to Unknown/Unlinked |

| Email Receipt | Customer asks for proof | Emails PDF |

| Delete Record | Uploaded in error | Permanently removes (admin-only) |

Handling “No Customer Linked” rows

If neither the customer nor invoice can be guessed, the grid shows No Customer Linked. Edit the payment to attach a customer, then Assign Invoice. The entry stays Unapproved until both steps are done, preventing bogus revenue.

Dual-control & fieldworker notes

- Fieldworkers can add any tender type (card, cash, EFT, cheque) once you grant Display booking billing amount to fieldworkers permission.

- If Keep payments pending until reconciled by an authorised user is ON, offline entries remain Unapproved until a second user approves them — standard dual-control best practice.

Removing an incorrectly matched payment (unassign vs. delete)

Deleting a payment destroys audit evidence and can unbalance ledgers. Unassigning keeps data intact:

- Finance → Invoices → Payments Reconciliation → Approved or Unapproved.

- Locate the payment → … Actions → Unlink Invoice (or Reassign Invoice to link straight to the right job).

- If already approved, click Reject first to reverse approval; then Unlink.

- The payment returns to Unknown/Unlinked for proper reassignment.

Why unassign, not delete?

- Prevents data loss — payment still exists for re-linking

- Keeps audit trail whole — auditors see original capture + correction

- Maintains financial accuracy — balances stay correct; no write-offs

Deleting should be reserved for duplicate or erroneous imports only.

Best-practice checklist

- Import & clear daily to avoid month-end surprises.

- Use bank-reference patterns (“INV-####”) for auto-matches.

- Never delete real money; unassign or reassign instead.

- Enable Card Account Updater in Stripe/Square to cut declines on stored cards.

FAQs

| Q | A |

|---|---|

| Do I need an invoice before matching? | Yes; generate one manually if the job isn’t closed. |

| Can I split one deposit across many invoices? | Yes — use Bulk Assign or the split-payment tool, like Xero’s multi-invoice match. |

| What if I chose the wrong invoice? | Use Unlink to return it to Unknown, or Reassign to switch invoices. |

| What happens after deletion? | The payment vanishes forever — use only for duplicated imports. |

| Does card failure log? | Yes; OctopusPro stores the gateway error and suggests alternate payment. Stripe’s Card Account Updater reduces future declines. |

To stay updated, please subscribe to our YouTube channel.