View & Manage Payments for a Booking

OctopusPro’s Invoice & Payment card lets you drill into every dollar attached to a booking—from deposits and partial instalments to refunds—without leaving the job screen. Clear, real-time insight into payments accelerates cash-flow, cuts disputes, and supports accurate reconciliation across your accounting stack.

Why Payment Visibility Matters

Proper payment tracking:

- Improves cash-flow forecasting by flagging overdue invoices instantly.

- Reduces manual reconciliation errors through a single source of truth that mirrors accounting-system balances.

- Boosts customer satisfaction when staff can answer “Have I paid?” on the spot.

- Enforces security & refund controls—only authorised users can trigger refunds or email receipts, a practice recommended by Stripe and Square.

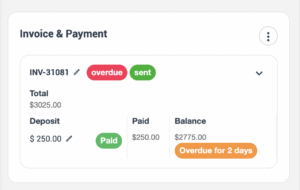

Anatomy of the Invoice & Payment Card

| UI Element | Purpose |

|---|---|

| Invoice-ID link (e.g., INV-31081) | Opens the full invoice record |

| Status chips (sent, overdue, paid) | Visual lifecycle tracker |

| Total / Deposit / Paid / Balance | Snapshot of amounts |

| Balance pill (“Overdue for x days”) | Expands a line-item list of all associated payments |

| Ellipsis menu | Edit invoice, issue credit note, or open reconciliation links |

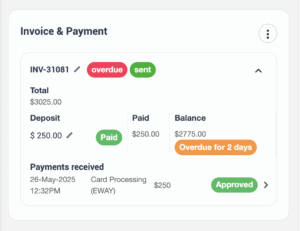

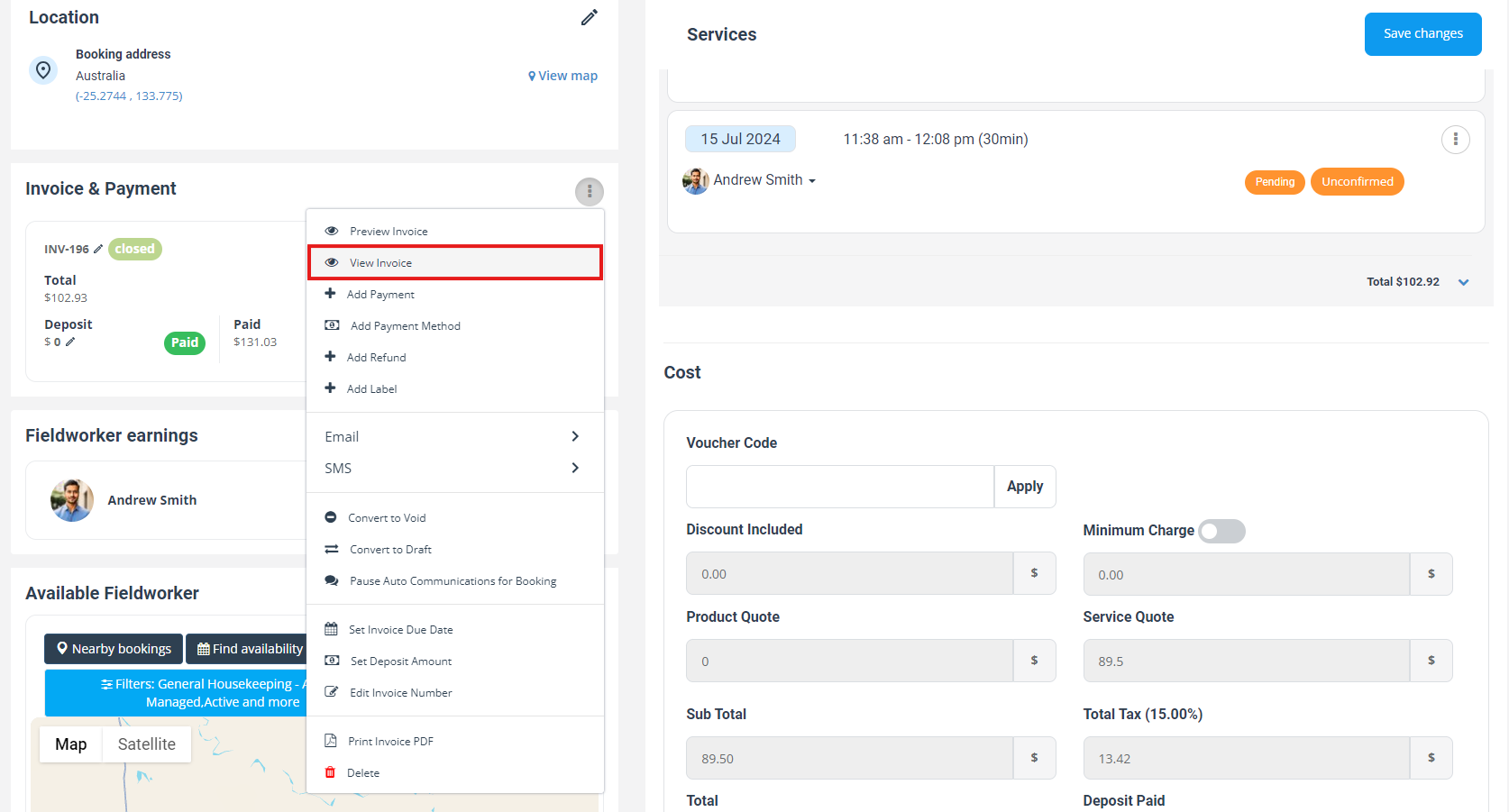

Viewing Payments Directly from a Booking

- Bookings ► open job record.

- Locate the Invoice & Payment card.

- Click the Balance badge (e.g., Overdue for 2 days) to reveal each payment row—date, method, amount, and approval state.

- Optional: hit View Invoice to open the invoice modal for deeper detail (reference number, fieldworker name, manual/online flag).

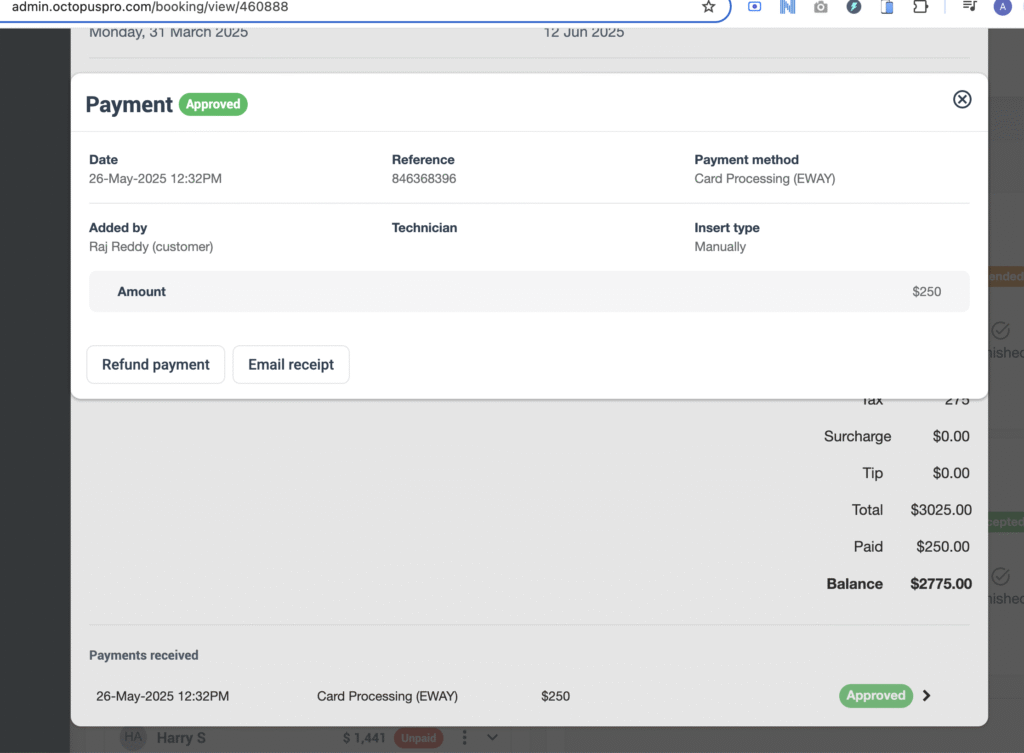

Example: A $250 deposit (paid by Card) is marked Paid, while the $2,775 balance shows Overdue 2 days. Admins can decide whether to send an automatic reminder or apply a late-fee surcharge.

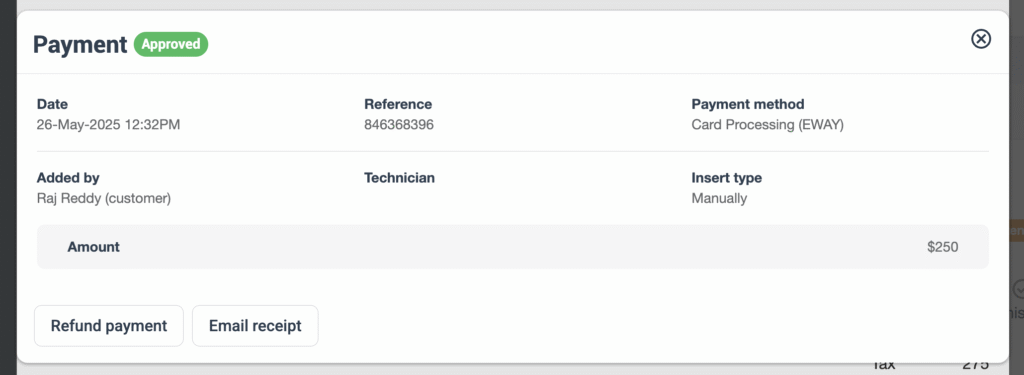

Inside the View Invoice Modal

- Header with live invoice status (Approved, Awaiting Payment, etc.).

- Payment table—date, reference, method, who added it, fieldworker tag, insert type (manual vs. gateway).

- Action buttons: Refund payment (invokes secure reversal flow) or Email receipt (emailed PDF + online pay link).

Viewing All Payments via Payment Reconciliation

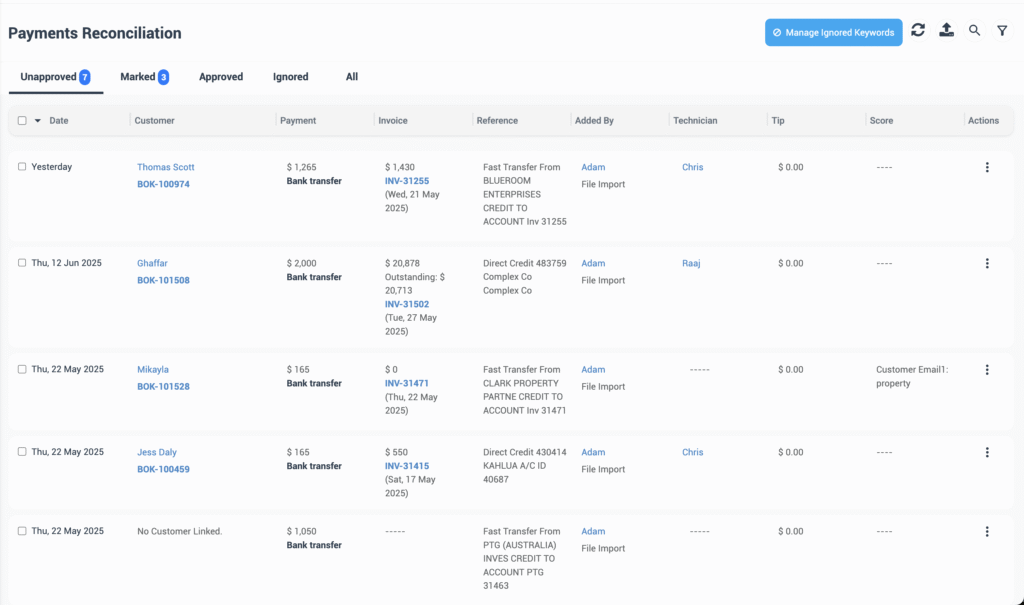

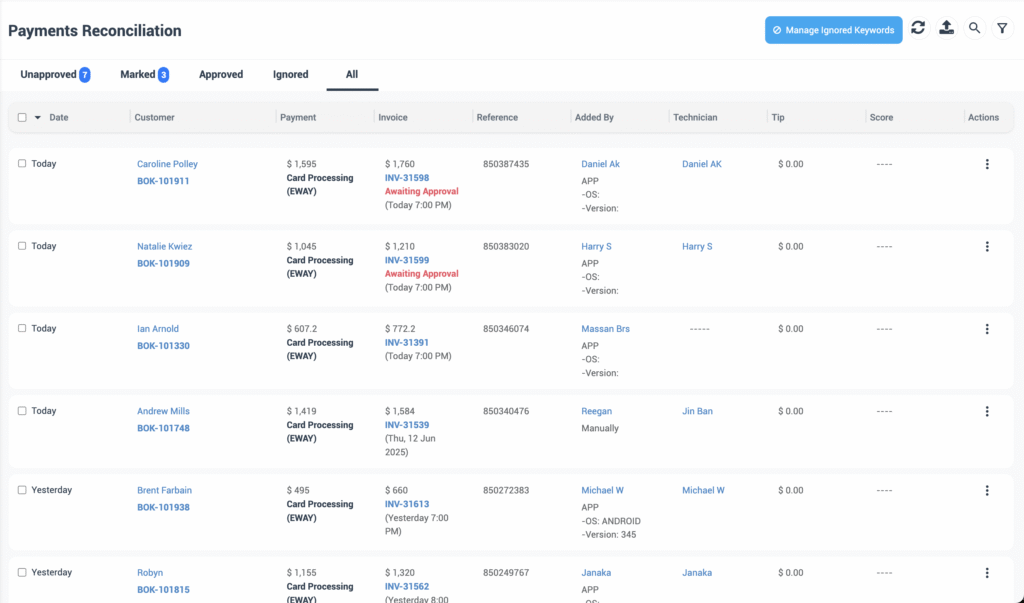

The Payments Reconciliation workspace converts raw bank or gateway transactions into invoice-matched records in a few clicks. Five tabs—Unapproved, Marked, Approved, Ignored, All—show at a glance what still needs attention, while the toolbar lets you Import, Refresh, Search, or Filter by trading name, fieldworker, date, method, or status.

Quick workflow

| Step | Action |

|---|---|

| 1 | Main Menu → Invoices → Payments Reconciliation (opens on Unapproved). |

| 2 | Optional: Import a bank file or click Refresh to pull new gateway feeds. |

| 3 | Use the Filter funnel or search box to isolate payments (e.g., today’s bank transfers). |

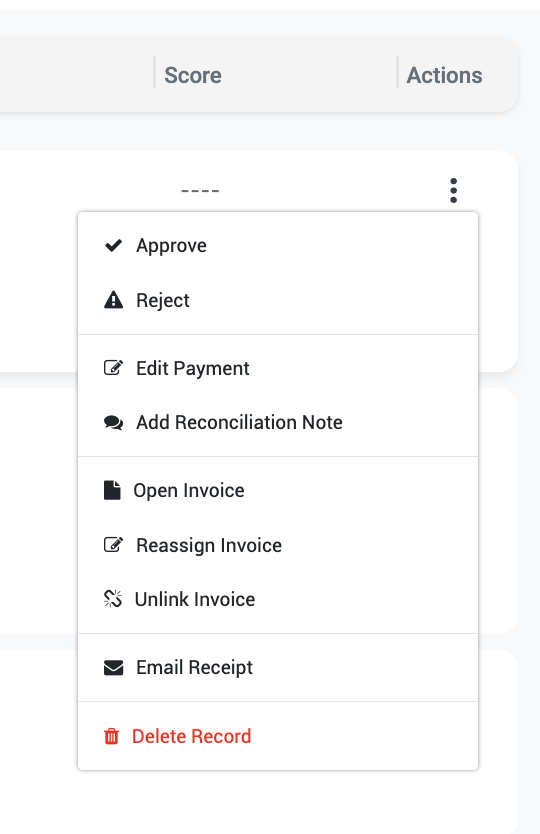

| 4 | Tick relevant rows → Approve (or Reject) in bulk from the action menu. |

| 5 | If needed, Edit, Reassign/Unlink Invoice, Email Receipt, or Delete directly from the actions-menu. |

| 6 | Export CSV or rely on the Xero/QuickBooks connector for automatic bank-match. |

Typical use-cases

- Bulk-approve imported or manually added payments

- Reject noise (e.g., bank-fee lines)

- Match bank transfer payments and deposits to multiple invoices with one click (similar to Xero’s Find & Match)

- Spot duplicates or fees quickly

- Push clean data to your accounting GL so the bank feed reconciles automatically, as recommended in QuickBooks guides

Benefit recap: Daily reconciliation trims days-sales-outstanding, slashes manual posting errors, and gives auditors a clear trail of who approved or altered each payment.

Common Scenarios & Solutions

| Scenario | How to Handle in OctopusPro |

| Deposit only | Record deposit; balance auto-calculates |

| Progress billing | Add multiple payments; each logs against Balance |

| Refund requested | Open payment ▶ Refund payment; status flips to Refunded |

| Overdue follow-up | Set auto-reminder in Invoice settings |

Best-Practice Checklist

- Set clear payment terms and display them on every invoice to avoid ambiguity.

- Collect deposits or card-holds on high-value jobs to reduce cancellations.

- Automate overdue alerts to shorten days-sales-outstanding.

- Schedule weekly reconciliation against bank feeds to catch discrepancies early.

- Restrict refund rights to senior roles for fraud prevention.

Frequently Asked Questions

| Question | Answer |

| What counts as a “payment” in OctopusPro? | Any transaction—gateway capture, manual cash entry, refund, or adjustment—posted to the invoice ledger. |

| Can fieldworkers see payment details in their app? | Only if they have the View Invoice permission; otherwise they see status-only badges. |

| How do split payments appear? | Each part-payment is logged separately with its own timestamp and method, and the Balance updates in real-time. |

To stay updated, please subscribe to our YouTube channel.