Consolidate & Merge Multiple Invoices into One

Consolidating several job-level invoices into a single group (consolidated) invoice transforms scattered one-off bills into a disciplined, periodic-billing workflow. Automatically generated at any cycle you set on the customer profile—weekly, monthly, or custom—the group invoice lists every service or product line with its original booking reference and date, so clients can review all work in one place, pay once, and close their account for the period. Finance teams post one receivable instead of dozens, trimming payment-processing fees, reducing administrative workload, all while preserving a full audit trail for regulatory transparency. OctopusPro’s Combine & Merge Invoices feature does the heavy lifting: it locates eligible invoices, creates a new invoice number, presents a detailed merged view, and lets you revert or extend merges when needed—making life easier for customers who expect periodic billing or require a single invoice to cover multiple bookings.

When should you raise a single group invoice instead of many job-level bills?

- Periodic billing cycles: auto-generate one month-end (or custom-cycle) invoice that rolls up every booking completed during the period, so routine clients see a single statement instead of four separate ones.

- High-volume accounts (e.g., property-management firms): combine charges from multiple jobs and sites so the customer can issue one purchase order and one payment.

- Large, multi-stage projects: break the work into several bookings for scheduling, yet close the project with one master invoice for procurement sign-off and clear audit traceability.

- Customer-mandated single-payment documents: some organisations require a lone payable document to satisfy internal purchasing rules; merging invoices meets that compliance need.

- Volume-discount eligibility: aggregating spend on a consolidated invoice can push the account over tier thresholds, unlocking bulk-rate discounts or higher package margins for your business.

Beyond convenience, consolidated invoices lower missed-payment risk, simplify tax reporting, unlock volume-based pricing or bundled-service discounts, and preserve a clean audit trail by referencing every original booking number and service date.

Benefits of Merged (Consolidated) Invoices

| Key benefit | Why it matters | Typical use-case |

|---|---|---|

| Single payment request | Customers pay once instead of many times, reducing late or partial payments. | Residential clients who receive four weekly cleans but want one month-end bill. |

| Lower processing costs | One card charge or EFT run means fewer per-transaction fees. | High-volume commercial accounts paying by corporate card. |

| Cleaner A/R dashboard | Fewer open invoices simplify ageing reports and cash-flow forecasts. | Finance teams closing monthly books. |

| Volume-tier discounts | Rolling usage into one invoice can unlock higher discount tiers from suppliers or internal pricing matrices. | Multi-site property manager qualifying for bulk-service rates. |

| Simpler dispute handling | One statement, one touch-point, faster resolution of any query. | Facilities manager querying charges for several service visits. |

| Forecast accuracy | Predictable billing cycles make revenue and cash-inflow easier to model. | Businesses relying on recurring monthly income. |

| Marketing bundles & upsells | Bundled line items on a single invoice clarify value and encourage package upgrades. | Selling seasonal maintenance bundles (e.g., HVAC + duct cleaning). |

| Audit-ready traceability | Each line retains its original booking ID, date, tax, and rate for compliance checks. | Organisations subject to annual external audits. |

Workflow – creating and managing a merged (group) invoice

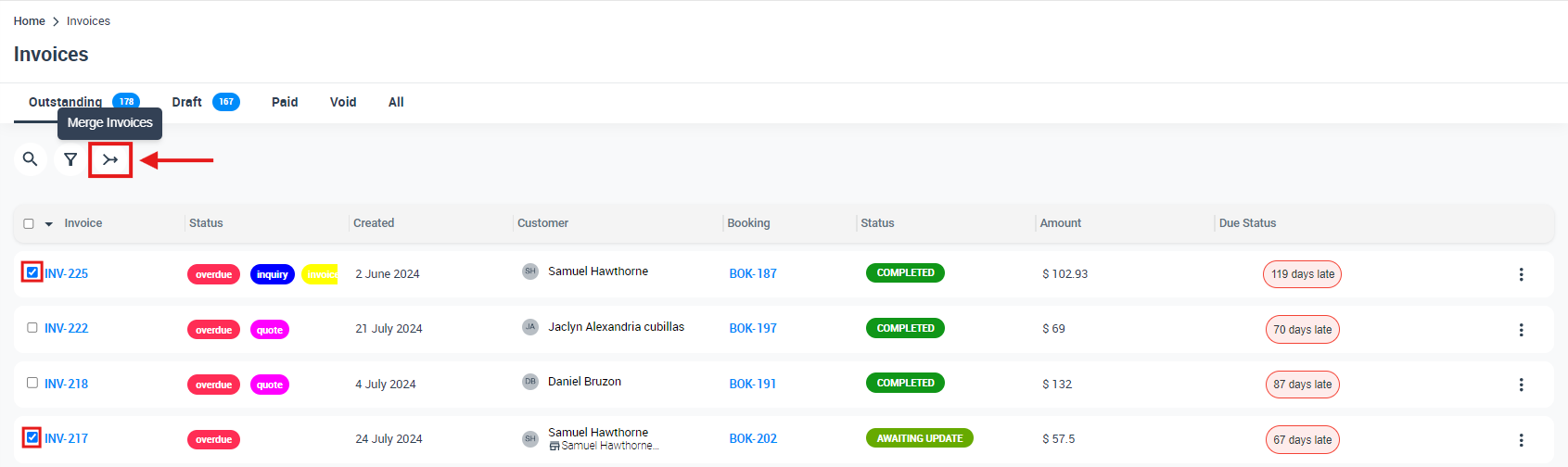

1. Select the invoices

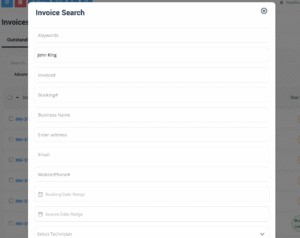

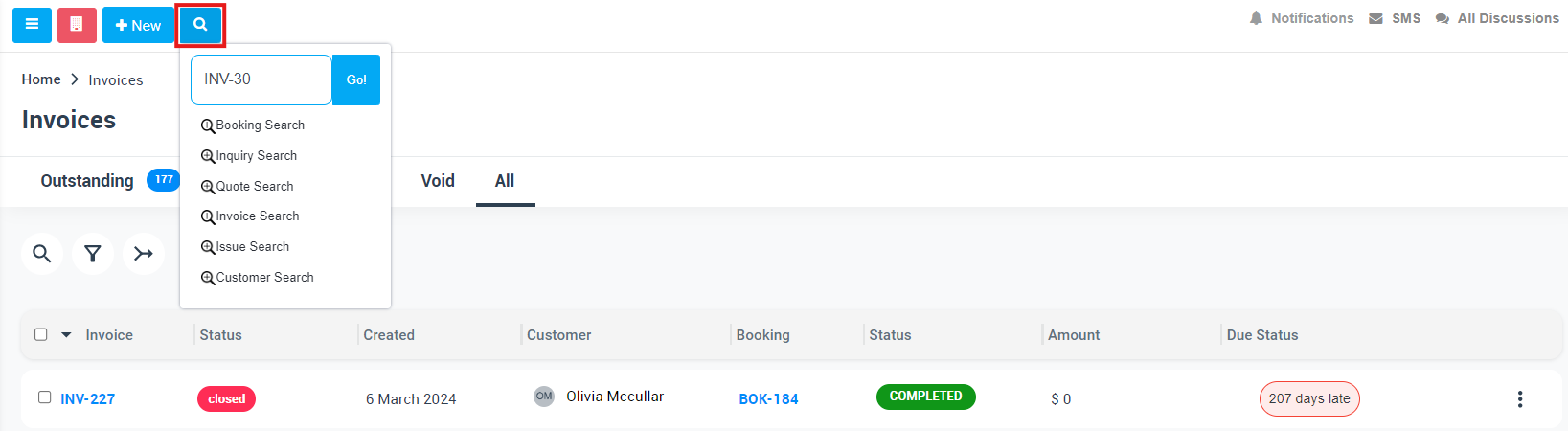

- Go to Invoices ➜ Advanced Search. Filter by Customer (you can also apply Label, Status, or Field-worker filters).

- Tick two or more invoices for the same customer; OctopusPro blocks cross-customer selections.

2. Merge them

When ≥ 2 rows are checked, the toolbar shows Merge invoices. Click it, or multi-select invoices from the customer’s Profile ➜ Invoices tab and press Merge there.

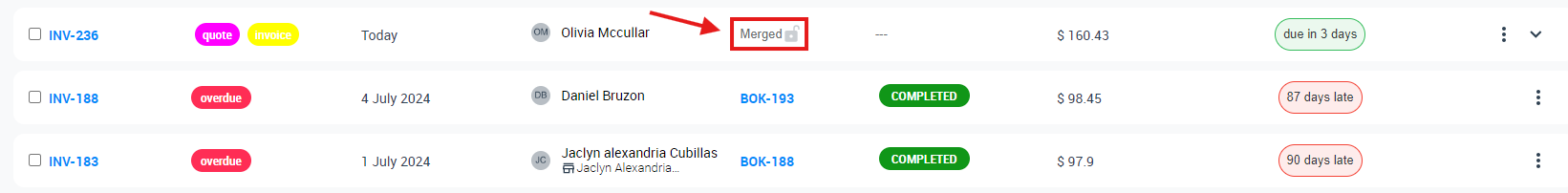

3. System issues a new invoice number

The source IDs (e.g., INV-62, INV-63) are retired and a fresh sequential number (e.g., INV-76) is created. Search for the old IDs and you’ll be redirected to the new group invoice, preserving traceability.

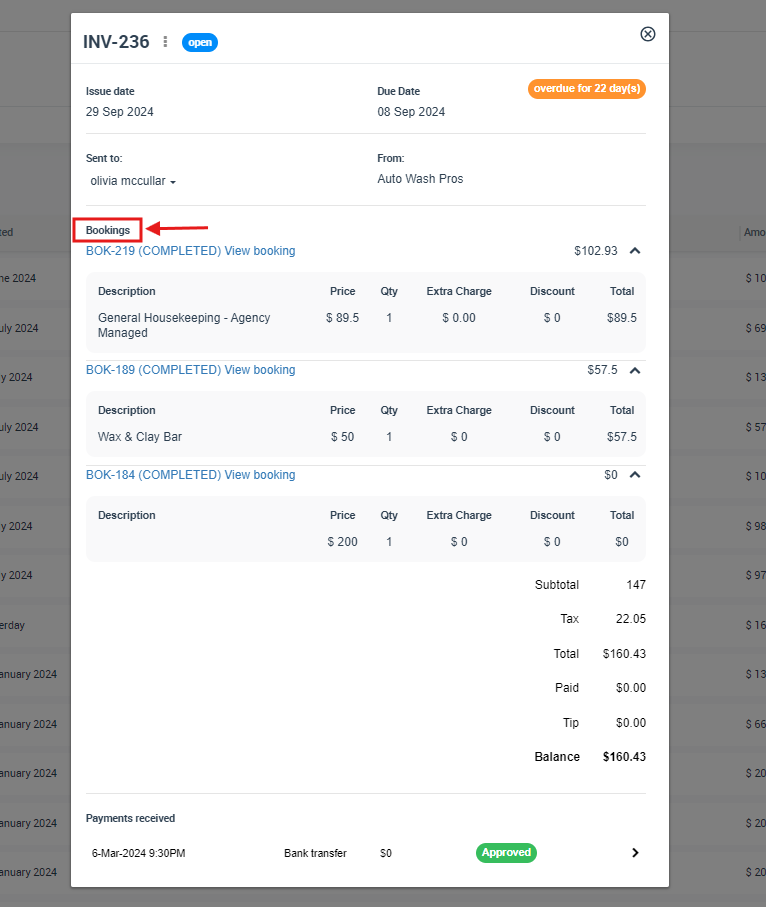

4. Review the group invoice

The layout mirrors a standard invoice but:

- Groups lines by Service Date / Product Date.

- Lists the Booking # beside every line.

- Rolls up deposits, taxes, and the outstanding balance.

Tip: merge invoices before exporting to your accounting package (Xero/QBO) to avoid duplicate syncs.

Ongoing management

| Task | How to do it | Rules to remember |

|---|---|---|

| Add more invoices later | Select the merged invoice plus new drafts → click Merge again. Totals refresh automatically. | Same customer, no payments on the new drafts. |

| Revert (un-merge) | Actions ➜ Revert Merged Invoice → confirm. OctopusPro deletes the group invoice and restores the originals. |

Only possible if the merged invoice has no payments and is not synced to external accounting. Remove/refund payments first if needed. |

| Search & view | The group invoice appears in Invoices ➜ All with a “Merged” label; original IDs redirect to it. | Field-workers cannot open the group invoice; they still see their own booking costs only. |

These streamlined steps let you consolidate, extend, or roll back invoices without breaking audit trails, orphaning payments, or falling out of sync with your general ledger.

Limitations & guard-rails for merged invoices

Merging invoices is designed for convenience and audit-grade accuracy, so OctopusPro applies a few non-negotiable rules. These safeguards mirror standard accounting guidance for consolidated billing and protect you from cross-entity mistakes, orphaned cash, or gaps in your audit trail.

| Area | Rule enforced by OctopusPro | Why it exists |

|---|---|---|

| Customer lock | You can merge invoices only if they belong to the same customer; the customer field on a merged invoice is read-only. | Prevents cross-entity posting errors and keeps audit trails intact. |

| Payment lock | Invoices that already contain payments (even $0.01) can’t be merged. Likewise, a merged invoice that later receives a payment can’t be reverted until you remove or refund those payments. | Eliminates the risk of “orphaning” cash that no longer points to an invoice. |

| Accounting-sync lock | If an invoice is synced to an external ledger (QuickBooks, Xero, etc.), you must unsync and delete the external copy before merging or reverting. | Keeps the general ledger and OctopusPro in parity and avoids duplicate entries. |

| Edit lock | Line-item changes must be made on the original booking, not on the merged invoice. | Preserves booking-level tax, labour, and cost allocations. |

| Visibility lock | Only admin users can open merged invoices; field-workers see the cost break-down on their individual bookings, never the whole group invoice. | Protects multi-technician confidentiality and limits data exposure in the field. |

Practical implications

- Need to merge but a payment exists? Refund or delete the payment first, then merge. After merging, you can re-apply the payment to the new group invoice.

- Accidentally merged the wrong drafts? You can revert as long as no payment has been applied and the invoice hasn’t been synced to your accounting platform.

- Want to adjust pricing or tax? Edit the source bookings; the merged invoice refreshes automatically to reflect those updates.

- Field-worker access: They continue to see each job’s billing details (if your permission set allows) but never the master invoice, avoiding cross-technician visibility issues.

These constraints keep your consolidated-billing workflow compliant with recognised accounting practices while still giving you the flexibility to merge, unmerge, and update invoices without losing financial integrity.

Examples & use-cases

| Scenario | How a group invoice helps |

|---|---|

| Commercial cleaning – weekly retail cleans | Rolls four weekly jobs into one month-end invoice, so the store pays a single bill and finance reconciles one receivable. |

| Pool-care contract – bi-weekly service | Two visits per month appear on one statement with separate service-date rows, reducing card charges and admin time. |

| Property-management portfolio | A building manager with dozens of maintenance calls gets a consolidated invoice for each property instead of individual job invoices. |

| Facility-maintenance SLA | Client prefers a single invoice grouped by service type (HVAC, electrical) every 30 days for easier internal cost-code allocation. |

| Large renovation project | Labour, materials, and subcontractor bookings split over several months are merged into milestone Invoice #3 for the architect’s certificate of payment. |

| Agricultural or forestry services | Dozens of small equipment jobs are rolled into one quarterly bill, cutting invoicing time by up to 70 %. |

| Subscription IT support | Multiple on-site call-outs during the billing cycle feed one consolidated invoice, aligning with the customer’s monthly PO process. |

| Volume-discount trigger | Combining usage nudges the client into a higher discount tier, delivering savings and strengthening retention. |

Best-practice checklist

Best-practice checklist

| ✓ | Recommendation | Why it matters — benefit or risk avoided |

|---|---|---|

| ✓ | Label draft invoices (e.g., “Monthly-Bill”). | One search filter captures every draft at period end, so you don’t overlook a job when merging. |

| ✓ | Merge before emailing or syncing. | Prevents duplicate emails to the client and stops multiple small invoices from posting to your accounting ledger. |

| ✓ | Unsync ➜ merge ➜ resync when you use external accounting (QuickBooks/Xero). | Keeps totals in the general ledger identical to OctopusPro, eliminating reconciliation headaches. |

| ✓ | Add or import deposits only after merging. | Ensures the group invoice shows a single accurate running balance instead of scattering the deposit across several invoices. |

| ✓ | Set a billing cycle on the customer profile. | Automates month-end (or custom) consolidation so you never forget to merge invoices for recurring clients. |

| ✓ | Lock the invoice once you’ve sent it. | Stops accidental edits or further merges, preserving the integrity of the issued document for audit and customer confidence. |

| ✓ | Remove / refund payments before merging. | OctopusPro blocks invoices with existing payments; clearing them first prevents “orphaned” cash and lets the merge proceed smoothly. |

| ✓ | Edit tax, labour, or pricing codes on the source bookings. | The merged invoice copies each line exactly; fixing codes at booking level keeps tax reporting accurate and compliant. |

| ✓ | Include a concise cover note when emailing the invoice. | A short summary (period covered, PO number, terms) speeds the customer’s accounts-payable approval, shortening payment lag. |

| ✓ | Monitor volume-discount thresholds. | Consolidating spend can raise clients into a higher discount tier (or boost your margin); plan pricing accordingly. |

These examples illustrate when consolidated billing delivers the biggest wins, and the checklist ensures every merge is fast, accurate, and audit-ready.

Integrating Billing Cycles & Invoice Locking with Group Invoicing

OctopusPro lets you go beyond ad-hoc merging by automating the entire billing cycle and protecting each group invoice with a Lock/Unlock control.

A. Customer-level billing cycles

- Custom frequency: Set a daily, weekly, monthly, quarterly—or fully custom—cycle in the Billing Cycle tab of any customer profile.

- Hands-free consolidation: Every booking completed inside that window is auto-rolled into one invoice when the cycle ends.

- Cron-job auto-lock: Enable the “Billing Cycle Lock Invoices” automation in Settings › Communications › Automations; the system finalises (locks) each cycle’s group invoice as soon as it’s issued, preventing late additions.

- Flexible maintenance: Edit, pause, or disable a customer’s cycle at any time from their profile—ideal for seasonal contracts or paused services.

B. Locking & unlocking merged invoices

- Why lock? A locked invoice can’t be edited or accidentally merged again, safeguarding the integrity of the finished billing cycle.

- Lock: Invoices › All → open the merged invoice → Actions › Lock Invoice. Status changes to Locked.

- Unlock (admin-only): Same path → Actions › Unlock Invoice. Use this when you need to add more jobs before re-locking.

- Add more invoices after unlocking: Select the unlocked group invoice plus any new drafts → click Merge; totals refresh automatically and you can relock.

C. Why these features matter

| Challenge | Solution | Outcome |

|---|---|---|

| Recurring clients need predictable statements | Billing-cycle auto-merge | One invoice per cycle, no manual work |

| Risk of last-minute changes after issuing invoice | Invoice lock | Immutable document for audit & customer confidence |

| Adjustments required before dispatch | Admin unlocks, edits, relocks | Flexibility without losing control |

Add this automation-ready workflow to your Combine & Merge Invoices process to deliver perfectly timed, error-proof statements—every cycle, every customer.

Frequently Asked Questions (FAQ)

| # | Question | Answer |

|---|---|---|

| 1 | Can I merge invoices that belong to different customers? | No. A merge is allowed only when all selected invoices are issued to the same customer. This prevents cross-entity posting errors and keeps your audit trail intact. |

| 2 | Do deposits and other partial payments carry over when I merge? | Yes. Any deposits or part-payments already recorded on the source invoices are summed and shown on the merged invoice; the balance due recalculates automatically. |

| 3 | Can I merge invoices that already have payments or are synced to my accounting software? | No. Invoices with payments can’t be merged, and merged invoices that later receive a payment can’t be reverted. Unsync or refund/remove the payment first, then merge. |

| 4 | What happens to invoice numbers after a merge? | OctopusPro retires the original IDs (e.g., INV-62 & INV-63) and issues a new sequential number (e.g., INV-76). Searching any retired ID automatically redirects to the new group invoice—so traceability is never lost. |

| 5 | Can I split (un-merge) a group invoice later? | Yes—open Actions › Revert Merged Invoice. The system deletes the group invoice and restores the originals as long as no payment has been applied and the invoice hasn’t synced to your ledger. |

| 6 | Will scheduled reminders, late fees, or surcharges still work? | They follow the merged invoice’s new terms and balance. Any reminder schedules on the source invoices are disabled when the merge occurs. |

| 7 | Can I add more invoices to an existing group invoice? | Absolutely. Unlock (if locked), multi-select the merged invoice plus new drafts, click Merge again, and totals refresh automatically. The same rules—same customer, no payments—apply. |

| 8 | How do customer billing cycles interact with merging? | If the customer profile has a weekly, monthly, or custom billing cycle enabled, OctopusPro auto-merges every completed booking in that window into a single invoice at cycle close—no manual merge required. |

| 9 | Can I lock a merged invoice so no one edits it by mistake? | Yes. Open the invoice and choose Actions › Lock. Only admins can later Unlock, add more invoices, and re-lock. This protects finished statements from accidental changes. |

| 10 | Will merging affect my tax calculations? | No. Each line retains its original tax code; the merged invoice simply totals those amounts. This preserves compliance while giving customers one statement. |

| 11 | Can I merge quotes instead of invoices? | Convert the quotes to invoices first—then merge. |

| 12 | What if I hit the wrong invoice when matching imported payments? | In Payments Reconciliation, choose Actions › Reassign Invoice (or Unlink to return the payment to “Unknown”). The entry stays Unapproved until an authorised user clicks Approve, preventing ledger errors. |

These answers cover customer restrictions, partial payments, accounting-sync rules, numbering, reminders, billing-cycle automation, locking, taxes, and error recovery—giving you everything you need to run a smooth, audit-ready group-invoicing process.

To stay updated please subscribe to our Youtube channel.