Automated Travel-to-Job & Mileage Surcharge

Most field-service companies draw a standard service area—the neighbourhoods where fuel, drive-time, and vehicle wear are already baked into their call-out price. Industry playbooks advise adding a travel fee / trip charge whenever a request falls beyond that zone so long-distance jobs stay profitable.

OctopusPro’s Travel-to-Job / Mileage Surcharge automates the entire workflow:

- Quote stage (admin or Customer Portal).

When a booking address is entered, OctopusPro calls the Google Maps Directions API to calculate real-road distance from your depot to the site.

It then deducts your Complimentary Radius (e.g. first 20 km free) and multiplies the balance by your chosen per-km / per-mile rate—flat, tiered, or capped—to display a fair, up-front estimated travel fee. - Live job execution.

As soon as the fieldworker taps En Route (or triggers a geofence auto-check-in), the mobile app starts logging GPS mileage; accuracy is typically within 1 % of the vehicle odometer on modern smartphones.

On Arrived, OctopusPro recalculates the charge using the actual distance (minus the free radius) and applies any optional maximum cap distance to prevent sticker shock. - Instant, auditable billing.

The surcharge posts as its own line item—labelled “Travel-to-Site Fee” by default—and syncs automatically to QuickBooks mileage or Xero Expenses for seamless reconciliation.

Each entry stores date, start/finish addresses, distance, rate, and cap compliance.

Result: customers outside your normal coverage still get service, you recover every kilometre of cost, and nobody spends Sunday night doing spreadsheet maths.

What the feature does

When Travel-to-Job / Mileage Surcharge is activated, OctopusPro overlays a distance trigger onto every job:

| Setting / Action | How It Works | Why It Helps |

|---|---|---|

| Complimentary Radius | You set a free-travel buffer (e.g. 20 km) for each depot/branch. The first 20 km of any route are zero-rated. | Local customers see £0 travel, while long-distance clients can still book you without eroding margin. |

| Rate-per-Mile / km | Choose a pricing model:• Flat (e.g. $1.75 /km)• Tiered (first 30 km at $1.50, thereafter $1.20)• Capped (never exceed $85). | Mirrors industry trip-charge terms such as call-out fee, fuel surcharge, and truck roll—customers recognise the structure and trust the quote. |

| Google Maps Distance Engine | When a job is quoted (admin or portal), OctopusPro calls Google Maps Directions API to calculate real-road distance from the selected depot to the service address. Quote Travel Fee = (Maps Distance – Complimentary Radius) × Rate. | Delivers realistic estimates—no more under-quoting because of straight-line “as-the-crow-flies” distance. |

| Live GPS Capture (Mobile App) | Once the fieldworker taps En Route, the app starts logging turn-by-turn GPS mileage. It stops on Arrived. Final Travel Fee = (GPS Mileage – Complimentary Radius) × Rate (respecting caps/tiers). | Locks in the actual miles driven (< 1 % deviation vs. odometer) and automatically reconciles differences between quoted and real distance. |

| Instant Line Item | The travel fee posts as its own invoice line (e.g. “Travel-to-Site Fee”). Edits are audit-stamped, then synced to Xero or QuickBooks. | Guarantees no missed surcharges; accountants see travel revenue separate from labour/materials. |

| Optional Cap Distance | Enter a maximum distance cap (e.g. 100 mi). If (GPS Mileage) exceeds the cap, OctopusPro bills the cap instead. | Keeps long-range jobs competitive and avoids “sticker shock.” |

| Time-of-Day Multiplier (optional) | Add rush-hour or weekend multipliers (e.g. +15 % between 4–7 p.m.). | Covers fuel and labour premiums when traffic or overtime makes travel costlier. |

Where the distance starts

🏠 Origin point: OctopusPro measures travel from the fieldworker’s Assigned Origin Address (usually their home base or vehicle-storage yard) to the customer site.

Set or update this address at Staff ▸ [Fieldworker] ▸ Addresses—update it whenever the tech changes origin locations, and the next job will use the new starting point.

Key Benefits of the Travel-to-Job / Mileage Surcharge

- Protects your margin on out-of-area jobs – fuel and windshield time can drain 10 – 30 % of field-service profit when they’re not billed separately.

- Transparent, distance-triggered pricing – customer studies show mileage-based “trip charges” are viewed as fairer than flat, unexplained “service call” fees.

- Quote accuracy from day one – OctopusPro uses the Google Maps Directions API at booking time to show an up-front estimate, then overwrites it with the GPS-verified distance after the job, so customers never feel misled.

- Hands-free capture for fieldworkers – optional geofence auto-start/stop means drivers can’t forget to log miles, eliminating missed revenue and manual odometer notes.

- Rate flexibility that matches industry norms – configure flat, tiered or capped mileage fees (e.g., HVAC “trip charge,” tow-truck $4/mi cap) so your travel pricing aligns with what customers already expect.

- Scales with demand – Set company defaults, then override per service if you price heavy-haul higher than light vans.

- Audit trail & edit safety – any manual adjustment is time-stamped, preserving a compliant trail for auditors and finance teams.

With these advantages in place, OctopusPro transforms fuel costs and drive-time from profit-eaters into predictable, transparent revenue—while giving customers clear proof they’re only paying for the kilometres beyond your Complimentary Radius.

Setting up Travel-to-Job Mileage Surcharges

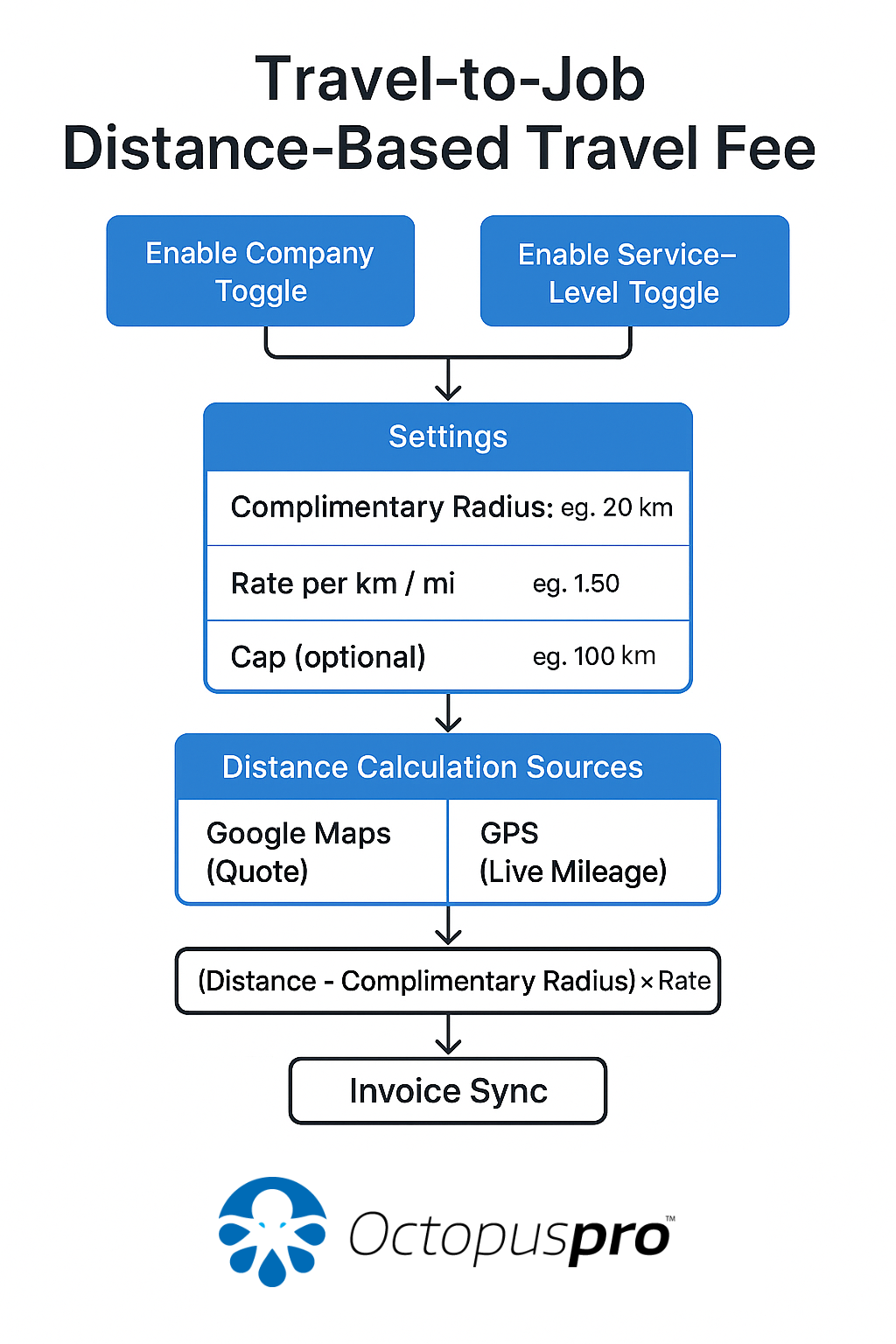

- Turn the feature on for the whole account

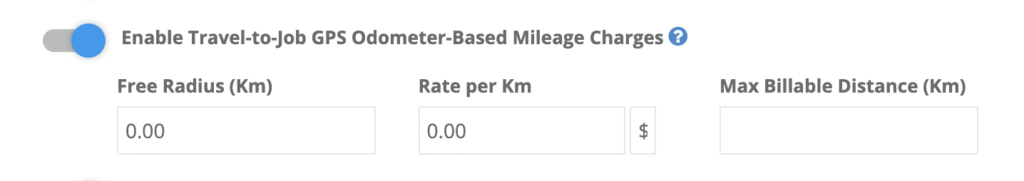

Go to Settings ▸ General Settings ▸ Booking Settings and switch on Enable Travel-to-Job GPS Mileage Charges.

Why? Once enabled, every new quote or job can auto-add a distance fee without spreadsheets.

- Tell OctopusPro how far you’ll travel for free

Enter a Complimentary Radius (for example, 20 km).

Enter 0 km if you want every kilometre or mile billed. - Choose your mileage tariff

- Select Rate-per-km or Rate-per-mile.

- Optional: add a Cap or build Tiers.

- Flat — pool companies often charge $1.75 / km beyond 10 km

- Tiered — HVAC firms might bill $1.50 / km for the first 30 km, then $1.20 after that

- Capped — never charge more than 100 km travel on a single call-out (handy for rural clients).

- How OctopusPro works out the distance

- Quotes & portal bookings – OctopusPro calls the Google Maps Directions API to calculate real-road distance from the fieldworker’s origin to the service address.

- Live job – the mobile app logs GPS mileage from En Route ▶ Arrived; OctopusPro recalculates the fee with the actual distance.

- Formula – (Distance from Origin – Complimentary Radius) × Rate, then apply any tiers or cap.

- Create service-level exceptions (optional)

- Open Services ▸ [Service] ▸ Settings ▸ Cost & Pay-rate.

- Toggle Enable Travel-to-Job charges for this service.

- Pick “Use account defaults” or “Custom for this service”.

- Example: courier vans $2.50 / km, tow-trucks $4 / mi.

Use Cases & Examples

| Industry | Typical OctopusPro Settings | Auto-Calculated Invoice Example |

|---|---|---|

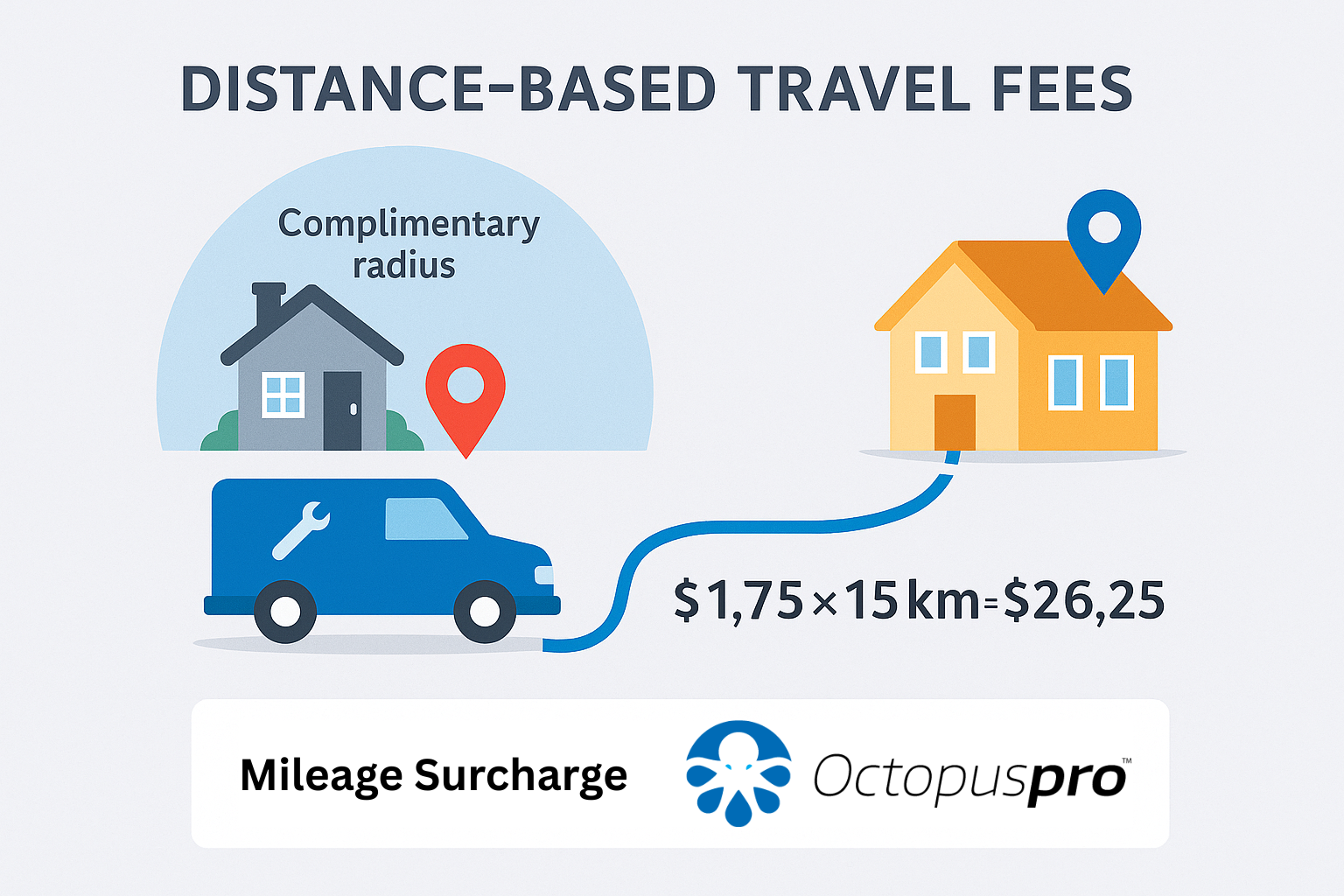

| Pool Maintenance | Free radius 10 km Rate $1.75 / km | Tech drives 25 km → (25 – 10) × $1.75 = $26.25 travel fee |

| HVAC Service | Free radius 25 km Rate $2.00 / km Cap 50 km | Customer 40 km away → (40 – 25) × $2.00 = $30(below 50 km cap) |

| Tow-Truck / Recovery | Hook fee $50 (separate line) Rate $4 / mi beyond depot | 12 mi tow → $50 + 12 × $4 = $98 |

| Mobile Veterinary | Free radius 15 km Rate £1.00 / km | Farm visit 42 km → (42 – 15) × £1 = £27 |

| Courier / Last-Mile | No free radius Rate $2.50 / km | 7 km route → 7 × $2.50 = $17.50 |

| Piano Movers | Free radius 20 mi Rate £3.11 / mi | 55 mi move → (55 – 20) × £3.11 = £108.85 |

| Mobile IT Support | Free radius 20 km Rate $1.00 / km | 45 km call-out → (45 – 20) × $1 = $25 |

| Snow-Plough Contractor | Free radius 25 mi Rate £2.50 / mi Cap 100 mi | 60 mi round trip → (60 – 25) × £2.50 = £87.50(below 100 mi cap) |

| Photography (Weddings) | Free radius 30 mi Rate $0.45 / mi | Venue 75 mi away → (75 – 30) × $0.45 = $20.25 travel fee |

| Heavy-Equipment Haulage | No free radius Rate $2.00 / mi | Digger moved 90 mi → 90 × $2 = $180 |

All distances shown are calculated from the assigned fieldworker’s origin address (mobile depot) to the customer location.

Frequently Asked Questions

Q: When should I use GPS Mileage Billing versus the Travel-to-Job Surcharge for heavy-equipment haulage?

A: Heavy-equipment haulage typically bills every mile driven—including detours for clearance or weight restrictions—at industry rates of $3–$10 per mile. OctopusPro’s GPS Mileage Billing records all turn-by-turn mileage via the app’s odometer, then applies your per-mile tariff, ensuring you capture every cost. In contrast, the Travel-to-Job Surcharge only charges miles beyond a complimentary radius, which doesn’t align with door-to-door haulage billing practices.

Q: Does the GPS count a round trip or only one-way?

A: OctopusPro only tracks the distance travelled one-way only, if you wish to charge for a round-trip, simply double the tracked distance, or double the fee charged per km/mi.

Q: What if the fieldworker takes a detour or misses a turn?

A: Dispatchers can edit the logged mileage before posting the invoice. Every manual adjustment is time-stamped, preserving a full audit trail—recommended practice for fleet auditors.

Q: Do customers see the complimentary radius before booking?

A: Absolutely. Both the Customer Portal form and admin-generated quotes display messaging like “First 10 km free, then $1.75 /km,” based on Google Maps road-distance estimates to set clear expectations.

Q: What happens if GPS signal is lost (e.g., in a tunnel)?

A: The mobile app caches distance offline and automatically syncs the data once the signal returns. Accuracy remains within about 1 % of the vehicle’s odometer on modern smartphones.

Q: Can I cap the travel surcharge so it never exceeds a certain amount?

A: Yes—set an Optional Cap (e.g., 100 km) in the service settings. If (Distance – Radius) × Rate exceeds the cap, OctopusPro will bill the cap distance instead.

Q: How accurate is the Google Maps quote compared to the final GPS charge?

A: Quotes use the Google Maps Directions API to calculate realistic road-distance estimates in real time. After the job, the GPS meter logs actual mileage, overwriting the estimate. Discrepancies over 5 % are rare and can be reviewed before invoicing.

Q: Are the mileage logs compliant with IRS or HMRC requirements?

A: Yes. Each surcharge line records date, start/finish addresses, distance, rate, and cap status, matching IRS Publication 463 and HMRC mileage-claim guidelines. CSV/PDF exports integrate seamlessly with accounting audits.

Q: Does the feature integrate with accounting software?

A: Travel surcharge line items sync directly to QuickBooks (mileage module) and Xero Expenses (mileage claims), enabling instant reconciliation without manual entry.

Q: Can I show the travel fee as a separate line on quote PDFs?

A: Yes—enable “Display travel as separate line” under Quote Layout settings to ensure the surcharge is clearly itemised for customers.

Q: Does the travel fee start from our office or the tech’s origin?

A: It starts from the fieldworker’s Assigned Origin Address—their mobile depot. OctopusPro never shows that street address to customers; it’s used only for distance calculations.

Q: We reassigned a job to a different tech—will the fee update?

A: Yes. When you reassign, the system recalculates the Google Maps distance using the new technician’s origin address so your quote and invoice stay accurate.

Q: What if a customer cancels after the fieldworker has already driven out?

A: The logged mileage remains in the draft invoice. You can choose to bill it as a “Travel Cancellation Fee” or waive it, depending on your cancellation policy.

Related distance-billing tools inside OctopusPro

Need to decide how to charge for getting to the job? OctopusPro gives you two purpose-built options:

- GPS Mileage Billing – a live, odometer-style meter that records every mile or kilometre your vehicle actually travels and multiplies it by your per-unit rate. Ideal for heavy-equipment haulage, medical transport, or any service that bills door-to-door mileage in full.

- Travel-to-Job / Distance-Based Surcharge – a “distance trigger” that adds a fee only when a booking leaves your complimentary service radius (e.g., first 20 km free, then $1.75 /km with an optional cap). Perfect for pool techs, HVAC, pest control and other trades that absorb local travel but need to recoup costs on out-of-area calls.

Both features rely on Google Maps for quote-stage road distance, then reconcile with GPS data on site, ensuring transparent, audit-ready billing that matches the trip-charge best-practices field-service consultants recommend. If you land on one guide first, follow the link to the other whenever your pricing model—flat-rate “radius plus mileage” or full per-mile metering—better fits the job.

To stay updated, please subscribe to our YouTube channel.